Liberal arts doctorate leaves borrowers with nearly $200K in student loan debt on $40K salary, study finds

A post-secondary degree can leave borrowers with a six-figure student loan balance, but it's important to remember that federal student aid isn't "free money." Keep reading to learn more about the average student loan debt and how you can pay it off.

Aspiring engineers, doctors and lawyers are required to obtain advanced post-secondary degrees that can cost hundreds of thousands of dollars. While taking on student loan debt may pay off in the form of higher earnings, that isn't always the case.

A doctoral degree in liberal arts has the lowest potential for paying off, according to a new study conducted by Dr. Andrew Gillen, an economist at the Texas Public Policy Foundation. These graduates are tasked with paying nearly $200,000 worth of student loan debt on a salary of just $40,000.

Dr. Gillen compiled data from the Department of Education to estimate how much federal student loan debt graduates accumulated based on their field of study. Unsurprisingly, some of the largest debt balances were among post-secondary degree holders in medical fields like dentistry ($138,857), medicine ($179,553) and optometry ($178,870).

But among the courses of study that almost guarantee a well-paying career, some other advanced degrees came with a surprisingly high price tag: Alternative medicine ($230,103), dispute resolution ($135,844) and liberal arts ($199,115), for instance.

BIDEN ADMINISTRATION ISSUES 'FINAL EXTENSION' OF STUDENT LOAN FORBEARANCE PERIOD

While a college degree can open doors to more advanced fields, it's important for students to understand the implications of taking out high amounts of student loan debt. Taking out six-figure debt for a degree in a relatively low-paying field can be "disastrous" for graduates, Dr. Gillen added.

If you're struggling to pay off high amounts of college debt, consider your student loan repayment options like private student loan refinancing. You can compare student loan refinance rates without impacting your credit score on Credible.

DEPARTMENT OF EDUCATION LAUNCHES INQUIRY TO FIX PSLF PROGRAM

What is the average student loan debt?

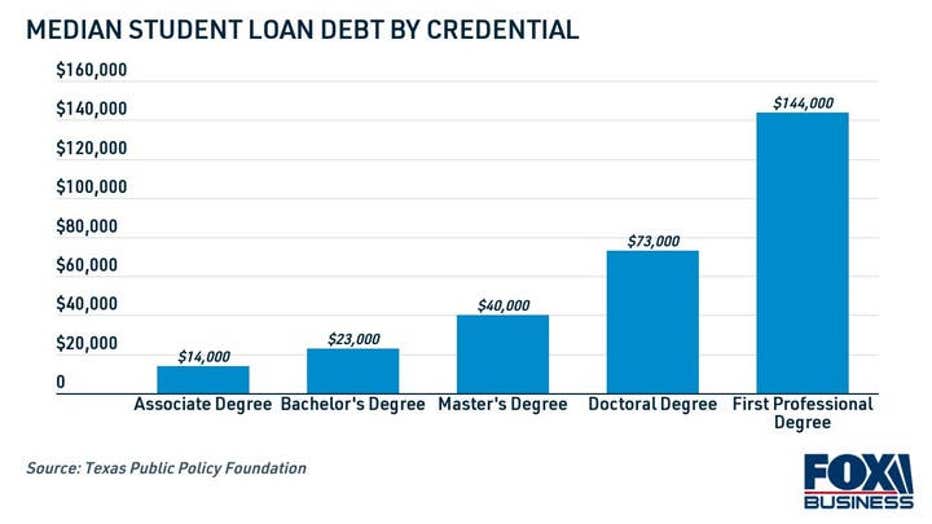

The average student loan debt per borrower depends on the type of degree they have. The average amount of debt students take out to earn a Bachelor's degree is $23,000, compared to $144,000 for a professional degree.

The overall cost of student debt also depends on the academic field. The most expensive course of study is a doctoral degree in pharmaceutical sciences, leaving graduates with a towering $271,378 worth of federal student loan debt. This career path is more likely to pay off, though, with a median salary of $119,806.

In contrast, a Master's degree in accounting leaves students with $28,341 worth of student loan debt on a $60,311 salary. A Bachelor's in computer science costs just $17,052 but pays off quickly with a median salary of $69,338.

BIDEN ADMINISTRATION DISCHARGES ANOTHER $5.8B IN STUDENT LOAN DEBT

Dr. Gillen said that one of the most important takeaways of the study is the high amounts of debt borrowers take out for graduate degrees.

"At the undergraduate level, we do have limits on how much students can take out, but what they have done is constrained overborrowing at the undergraduate level for the most part," he said. "At the graduate level, the overborrowing is really concerning."

The federal student loan limits for undergraduates are $31,000 for dependent students and $57,500 for independent students. But PLUS loans for graduate students don't have the same borrowing limits, which makes it easy to overborrow when obtaining a post-secondary degree. Besides, PLUS loans have the highest interest rate of all federal loans, at 6.28%.

WHAT TO DO IF YOUR STUDENT LOAN SERVICER IS SHUTTING DOWN

How to reduce student loan debt

Student loan expenses can be a costly burden on your budget, preventing you from achieving financial milestones like saving for retirement and buying a house. But there are ways to pay off your student loan debt faster and even save money while doing it. Here are a few moves to consider.

COLLEGE TUITION IS UP 33% SINCE 2000: HOW TO COPE WITH RISING COSTS

Refinance while interest rates are low

Student loan refinancing is when you take out a new student loan with better terms to repay your current loans. Qualifying for a lower student loan interest rate can help you reduce your monthly payments, get out of debt faster and save money over the life of the loan.

Because student loan refinance rates are near all-time lows, now is a good time to refinance your student loan debt. Well-qualified borrowers who refinanced to a shorter loan term using Credible were able to pay off their debt years faster and save nearly $17,000 over time.

If you have federal student loans, keep in mind that refinancing to a private lender means that you'll lose federal benefits like COVID-19 deferment, income-driven repayment plans, and student loan forgiveness programs.

You can learn more about student loan refinancing and compare interest rates on Credible.

FAFSA APPLICATIONS FOR THE 2022-23 SCHOOL YEAR OPEN SOON

Enroll in automatic payments

Setting up direct deposit on your student loans ensures you'll never miss a payment, but there's an added benefit to enrolling in automatic payments. Many lenders offer an autopay discount in the form of a lower interest rate, which can help you save even more money while you repay your debt.

98% OF PUBLIC SERVICE LOAN FORGIVENESS APPLICATIONS REJECTED

Pay more than the minimum to reduce interest charges

Your student loan payment is the minimum amount you owe, but you may be able to save thousands and pay off your debt faster if you can afford to make more than the minimum payment. Use Credible's student loan payment calculator to see how paying off your loans faster can save you money over the life of the loan.

AVOID THESE STUDENT LOAN MISTAKES WHEN LIVING OFF CAMPUS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.